Dear Investors,

We are pleased to provide you with our year-end report summarizing our results for the past year and some current insights as to the make-up of our existing portfolio. At the outset of Bristol Gate our objective was to apply proprietary technologies to internal data bases in conjunction with “productive capital analysis” to produce better long-term results than the market indices we compete against. We are pleased this “evidence” driven discipline has worked in our favour but believe we are not yet finished building a better mouse trap. Ongoing research is sure to reveal some way in which we might be able to consistently add even more value. In the meantime please review the results and the report.

PERFORMANCE RESULTS

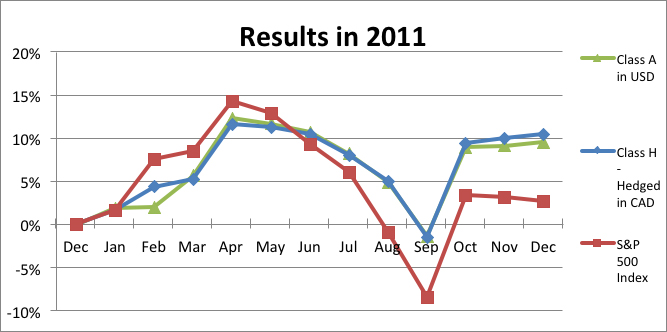

The Bristol Gate US Dividend Fund 2011 results [January 1st through December 31st] continue to validate our investment discipline that stocks with the highest expected dividend growth will deliver superior results especially in difficult markets. These charts report the results for the year [performance is net of all fees]:

| Class A Net in USD |

Class A Net in CAD |

Class H Hedged Net in CAD |

S&P500 Total Return USD |

Average US equity fund manager |

| 9.55% | 12.02% | 10.51% | 2.11% | (1.02%) |

DIVIDEND GROWTH RESULTS

Our dividend prediction methodology and capital analysis produces solid results. During 2011:

(1) All portfolio companies increased dividends [also true in 2010]

(2) Median Year Over Year dividend growth of companies in the portfolio = 16%

(3) Annual dividend growth captured in the fund since inception = 13.7%

The first two points confirm the credibility of our discipline; the third offers what we believe is a unique long-term advantage for our investors.

2011 illustrated one of the hallmarks of our discipline – namely, although our portfolio will decline with the market in distressed times, the recovery of value is very much quicker. Note especially the period from April through October in the chart above.

PORTFOLIO FUNDAMENTALS

During the year two of our portfolio holdings were sold. National Semiconductor was acquired by Texas Instruments and ITT underwent a fundamental restructuring by splitting into three independent operating units. We replaced some portfolio companies [of our 22 in total] by adding Expeditors International [air delivery logistics], CSX [railroad], Equifax [credit analysis], Parker Hannifin [control systems], Polo Ralph Lauren [apparel], Scripps Networks [cable TV broadcasting] and Western Union [payment services].

Conventional valuation metrics for the portfolio at year end:

| Holdings | Price to 2012 EPS |

Cash flow Growth |

Return On Assets |

Return On Equity |

|

| Bristol Gate Fund | 22 | 12.7 | 12.3% | 11.1% | 36.8% |

| S&P500 | 501 | 12.1 | 3.7% | 9.4% | 23.0% |

We don’t find exceptional dividend growth in all sectors or industries. Hence our portfolios are typically more focused. Here is Morningstar’s analysis of the sector distribution of the Fund’s portfolio:

| SECTOR | PortfolioWeight | S&P 500Weight |

| CYCLICAL | 32.49% | 26.76% |

| Materials | Nil | 3.06% |

| Consumer cyclical | 23.28% | 9.31% |

| Financial services | 9.20% | 12.61% |

| Real estate | Nil | 1.78% |

| SENSITIVE | 44.96% | 45.12% |

| Communications | Nil | 4.47% |

| Energy | Nil | 11.49% |

| Industrials | 35.79% | 11.59% |

| Technology | 9.17% | 17.56% |

| DEFENSIVE | 22.55% | 28.12% |

| Consumer defensive | 13.46% | 12.28% |

| Healthcare | 4.58% | 11.94% |

| Utilities | 4.51% | 3.90% |

Source: www.morningstar.com Companies in the index are weighted by market capitalization.

LOOKING AHEAD

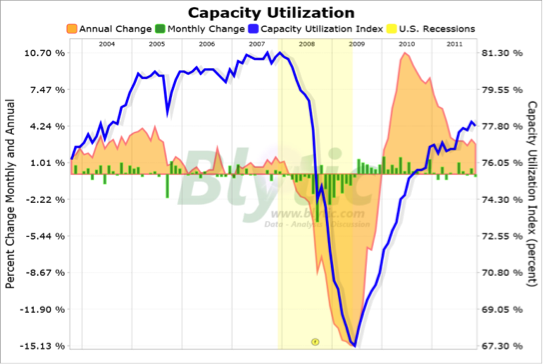

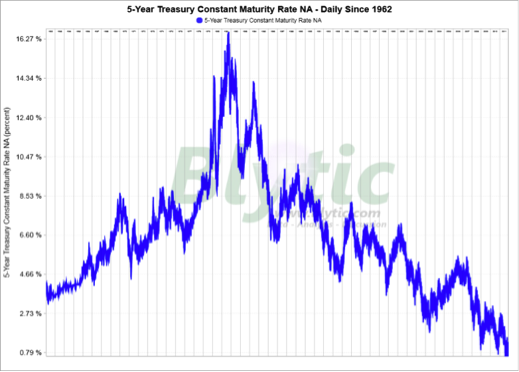

Looking ahead to 2012 we believe markets are focused on two significant concerns. Firstly, in the US the steady rise in industrial output which began in mid-2009 is continuing [see the Capacity Utilization chart next]. This positive news is coupled with historically low interest rates [the following chart illustrates the historical interest rate decline over the past 50 years in US Treasury bonds], but offset by a measure of negative consumer sentiment reflecting the job situation, housing market weakness and the political stalemate.

Secondly, in Europe, there is a need for a major effort to reduce public debt, at least the growth in it, and address the exposure of European banks to Greek, Spanish, Portugese and Italian sovereign debt. This is hampered by an unproductive Euro-zone political and economic decision process.

Our portfolio is positioned with companies growing in Asia and South America and holds no banks. Cash flow [from operations] growth across all companies is very strong and there is a clear absence of a debt overhang. Our 2012 minimum dividend growth target is 15.6%, which is up almost 15% from 2011.

ABOUT US

During the summer we increased our research staff to three and significantly added to our computer analytical software and company fundamentals data base. We believe we can leverage the results-proven platform of our dividend growth discipline by developing complementary portfolio solutions for investors that offer better risk management alternatives to indexes, ETFs and other managers.

We are pleased to report that Scotiabank has been a constructive and co-operative partner in supporting our development efforts.

During this year we completed the process of having our performance returns independently verified. Reported returns are consistent with the GIPS® standards, a world-wide benchmark for money managers. The verification auditor completes its report quarterly and the latest results will be posted to the web-site. These results offer an unbiased report which allows prospective investors to evaluate our performance. We will send you the final reports for 2011 when the verification auditor has completed its work.

This year the “tracking portfolio” is entering its fifth year and, despite being tested by volatile markets in the face of major economic shifts and skeptical investors, we have managed to perform well on the investment stage. Perhaps the best lesson we have learned is the importance of understanding risk and managing downside risk. We will continue to be focused on providing our investors solid returns but will remain vigilant in protecting the capital entrusted to us. Thank you for the opportunity.

We wish you all the best for 2012.

| Richard Hamm Chief Executive Officer  |

Peter Simmie Chief Investment Officer  |