Dear Investors,

We are pleased to provide you with our year-end report summarizing our results for the past year and some insights on the make-up of our existing portfolio. In the past year we have continued to hone our skills in the pursuit of great companies that are able to substantially increase their dividends in the year ahead. We believe we have assembled a portfolio of such companies all sharing the same reliable financial strength which will allow us to meet our expectations.

There is no doubt that total return and dividend growth go hand in hand. We have found that the best way to achieve returns in excess of the benchmark is to select companies with strong free cash flows where management intelligently use that cash flow in all aspects of their business including the payment of growing dividends. The compounding rate of return of these dividends not only provides protection against inflation, it is a key determinant to long term share price performance—the rest is sentiment.

PERFORMANCE RESULTS

The Bristol Gate US strategy 2013 results [January 1st through December 31st] are reported below report the results for the year [performance is gross of all fees, including recoverable withholding taxes]:

| Class A Gross in USD | Class AGross in CAD | Class H HedgedGross in CAD | S&P500Total Return USD | Dividend Aristocrats Index |

| 39.6% | 46.1% | 33.6% | 32.4% | 32.3% |

DIVIDEND GROWTH RESULTS

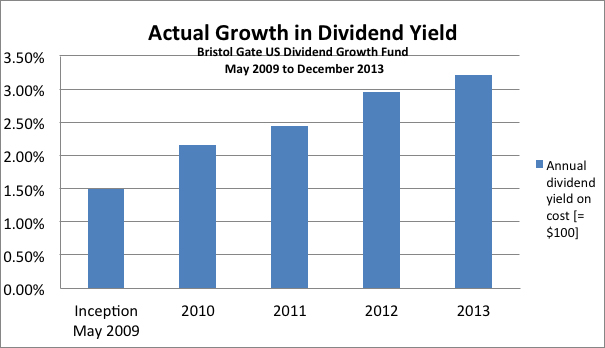

Our dividend prediction methodology and capital analysis produces solid results. During 2013:

(1) All portfolio companies increased dividends

(2) Median Year Over Year dividend growth of companies in the portfolio = 16.4%

(3) Annual dividend growth captured in the fund since inception = 17.7%

The first two points confirm the credibility of our discipline; the third offers what we believe is a unique long-term advantage for our investors.

2013’s US stock market performance was the best since 1995 and should be recognized as one of the best in the past four decades.

PORTFOLIO FUNDAMENTALS

During the year we replaced eight portfolio companies [of our 22 in total] by adding AmerisourceBergen (wholesale drugs), Equifax (credit services), Ingersoll-Rand (machinery), Haliburton (oil services), Nike (footwear), Noble Energy (oil and gas), Wal-Mart (retail) and Wyndham Worldwide (lodging). These decisions expanded the set of our companies that will deal with consumers benefiting from a US economic expansion. We estimate the 2014 dividend growth from these companies at 17.4%, higher than the companies replaced by 4.7%.

Conventional valuation metrics for the portfolio at year end:

| Holdings | Price to2014 EPS | Cash flowGrowth | ReturnOn Assets | ReturnOn Equity | DividendYield | |

| Bristol Gate Fund | 22 | 15.1 | 11.7% | 9.6% | 24.9% | 1.43% |

| S&P500 | 500 | 16.4 | 9.8% | 8.2% | 20.1% | 2.04% |

We don’t find exceptional dividend growth in all sectors or industries. Hence our portfolios are typically more focused. Following is Morningstar’s analysis of the sector distribution of the Fund’s portfolio. Our transition from consumer defensive stocks into consumer cyclicals and media [Equifax, Nike, Wyndham, Ross Stores, CBS and Disney] in the past two years reflects companies benefiting from the gradual economic recovery now underway in the United States. Our focus on industrial companies has been maintained. Following are the portfolio details at December 31 2013.

| Sector | Portfolio weight | S&P500 weight |

| Financials | 9.23% | 17.47% |

| Technology | Nil | 15.91% |

| Health Care | Nil | 12.59% |

| Consumer Services | 46.32% | 13.11% |

| Industrials | 18.82% | 11.81% |

| Consumer goods | 8.90% | 10.36% |

| Oil and Gas | 8.05% | 9.95% |

| Utilities | 4.38% | 3.28% |

| Basic materials | 4.30% | 2.90% |

| Telecommunications | Nil | 2.61% |

Source: Bloomberg. Companies in the index are weighted by market capitalization.

LOOKING AHEAD

Looking ahead to 2014 we believe markets are focused on two significant concerns. Firstly, in the US the steady rise in consumer confidence as households rebuild their balance sheets will continue with extremely low interest rates and some clarity on the public policy issues in Washington. The housing recovery throughout the United States will support this optimism.

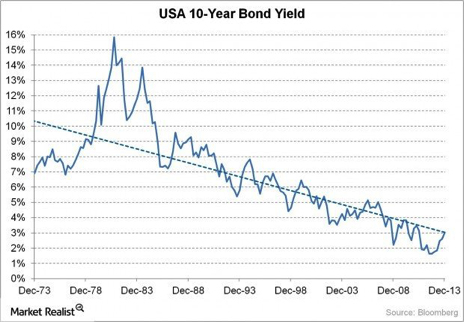

Another concern revolves about the direction of interest rates, which almost certainly does not mean down. The following chart illustrates the secular decline in the 10-year US Bond rates over the past 30 years. Our own research shows that our investment strategy – based on high dividend growth – does well in rising interest rate markets. The explanation appears to be that the sub-set of the economy Bristol Gate deals in is more isolated from interest rate rises. Why? The companies typically have small amounts of debt so rate rises do not eat into cash flows and superior management keeps them positioned to invest capital productively. In the end, the best protection against rising rates is investing in productive capital.

ABOUT US

The company has made significant progress in five areas we wish to report on.

(1) Market development: Our assets under administration now exceed $56 million [at December 31st] – a doubling over the past year. Significantly, we have commitments from Scotiabank and several other institutional investors which will raise our AUM to the $170 million level by May. Starting in December we have made a major effort to engage institutional accounts, in Canada and abroad, as clients and our performance and investment methodology has been well received. These efforts are supported by the company being included now on a number of institutional data bases used by investment professionals.

(2) Recognition by major financial institutions: Three major international banks, including RBC, have agreed to use the Bristol Gate funds as the underlying investment vehicle for Principal Protected Notes [PPNs] and other structured products to be offered to large institutional clients in Canada and abroad. This is a very big vote of confidence in our investment methodology, our performance results and our company’s capabilities.

(3) Operational management: Prior to the commitment of Scotiabank, Mercer Sentinel Group of Chicago, an international pension consulting firm, conducted an operational risk assessment of Bristol Gate. We have acted upon their recommendations, particularly in making client cash management and client reporting independent of the company and implementing certain improvements in technology services and records protection. In this regard, effective April 1st, we will consolidate our funds’ administration services with Apex Fund Services, which has handled our Cayman fund. Apex is one of the world’s largest independent fund administration companies, with over $28 billion of assets under administration, and 34 world-wide offices. Starting in April Apex will send statements and confirmations directly to investors. Apex will also be solely responsible for distributing all clients’ cash.

(4) Fund pricing: In April we will align the fees charged by our funds and establish a base management fee of 0.50% plus a performance fee of 10% of the net gains above 8.2%. for clients. For most unitholders this will represent a reduction in fees. In addition, we have created an option for banks and investment dealers to charge their clients a “trailer fee” of 1%. This fee will not apply to Bristol Gate’s clients.

(5) Distribution: Both the Cayman and Canada funds will be available through FundSERV, the administration platform which is used by Canadian banks and brokerages to execute purchases for their clients. Starting in April, the funds may be purchased on any business day [rather than just at month’s end]. Our strategy is also available through the investment dealers and portfolio managers connected with the National Bank Correspondent Network.

(6) Personnel: To meet the needs of these initiatives we have made the following additions in staff:

(i) Stephen Gross, CFA, CA – has joined the investment management group. Steve has over thirty years of senior management and research experience with several major investment companies

(ii) Stuart MacGregor, MBA – has joined the company as Chief Operating Officer. Stuart has over thirty years experience with BMO investment management, as the CFO of a public company and as a founder of Polar Capital

(iii) Sonia Wang – has joined the company as Senior Accountant. Sonia has been working part time with us for several years

In the past year our research efforts have been directed at three initiatives:

- A Canadian income growth portfolio: this is operational following a financial commitment from senior management with a report on performance consistent with the GIPS® standards started July 1 2013. An offering memorandum is being prepared and you will be notified when the fund is available to the public.

- A focused portfolio of US dividend growth stocks: having committed significant research to various aspects of portfolio design we have developed a portfolio of the “Top 11” of our US dividend stocks; the stocks have different weightings reflecting a risk management methodology we have developed; our evidence is that this methodology adds returns and lowers portfolio risk; this portfolio is operational with a financial commitment from senior management with a report on performance consistent with the GIPS® standards started July 1 2013

- A portfolio risk analysis system that would allow us to develop sound methods to evaluate client’s portfolios and establish asset mixes that would contribute to reducing risk

This year the “tracking portfolio” is entering its seventh year and, despite being tested by volatile markets in the face of major economic shifts and skeptical investors, we have managed to perform well on the investment stage. Our confidence in our ability to manage downside risk has increased thanks to the excellent efforts of our research staff whose job it is to be ever vigilant in protecting the capital entrusted to us.

Thank you for the opportunity.

We wish you all the best for 2014.

Sincerely,

| Richard Hamm Chief Executive Officer  |

Peter Simmie Chief Investment Officer  |