Dear Investors,

We are pleased to provide you with our year-end report summarizing our results for the past year and some current insights on the make-up of our existing portfolio. In the past year we have continued to hone our skills in the pursuit of great companies that are able to substantially increase their dividends in the year ahead. We believe we have assembled a portfolio of such companies all sharing the same reliable financial strength which will allow us to meet our expectations.

In addition to finding these “dividend growers” the other important focus of our work is on the risk management of the portfolio. In rising markets our active approach will produce results that are generally in line with the overall market, although we will lag behind when enthusiasm for a particular group of stocks – where we have little or no exposure such as financials or other cyclicals – become popular. We are willing to underperform during these periods which are typically short term because we know we are able to pick stocks that outperform in the long term. We do this by picking stocks that perform better in down markets, recovering to old valuations much faster and thus allowing capital to be invested on the positive side of the equation for a longer period. Simple math but a direct result of our efforts.

Almost daily the press likes to remind us of today’s investors’ dilemma. In periods of low economic growth and low interest rates where can one find adequate yield? At Bristol Gate we have a solution to the question and our results confirm it.

There is no doubt that share prices and dividend growth go hand in hand. We have found that the best way to predict long term returns is to select companies with strong free cash flows where management intelligently use that cash flow in all aspects of their business including the payment of growing dividends. The compounding rate of return of these dividends not only provides protection against inflation, it is a key determinant to long term share prices—the rest is sentiment.

PERFORMANCE RESULTS

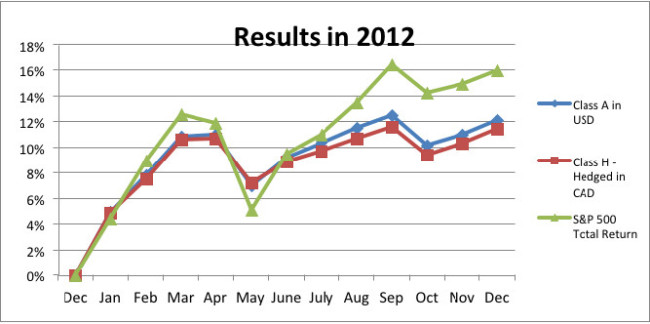

The Bristol Gate US Dividend Fund 2012 results [January 1st through December 31st] continue to validate our investment discipline that stocks with the highest expected dividend growth will deliver superior results especially in difficult markets. These charts report the results for the year [performance is net of all fees, including recoverable withholding taxes]:

| Class A Net in USD |

Class A Net in CAD |

Class H Hedged Net in CAD |

S&P500 Total Return USD |

Dividend Aristocrats Index |

| 12.15% | 9.71% | 11.43% | 16.00% | 11.6% |

DIVIDEND GROWTH RESULTS

Our dividend prediction methodology and capital analysis produces solid results. During 2012:

(1) All portfolio companies increased dividends [also true in 2010 and 2011]

(2) Median Year Over Year dividend growth of companies in the portfolio = 15.6%

(3) Annual dividend growth captured in the fund since inception = 13.7%

The first two points confirm the credibility of our discipline; the third offers what we believe is a unique long-term advantage for our investors.

2012 illustrated again one of the hallmarks of our discipline – namely, although our portfolio will decline with the market in distressed times, but the recovery of value is very much quicker. Note especially the period from March through May in the chart above. In 2012 we saw a major advance in the stock markets and our fund lagged the broad market, but exceeded the results in the dividend paying universe. The market advances were broadly based and included most sectors, including financials

Over the two year period, 2011 and 2012 our Class A Units in USD and Class H in CAD returned 23%, while the broad market returned 18%.

PORTFOLIO FUNDAMENTALS

During the year we replaced seven portfolio companies [of our 22 in total] by adding CBS (broadcasting), Deere & Co (agricultural implements), Walt Disney (media), Ecolab (chemicals/cleaning), Macy’s (department stores), Ross Stores (retail – fashions) and Target (retail). This shift has expanded our companies that will benefit consumers from a US economic expansion. We estimate the 2013 dividend growth from these companies at 19.7%, significantly higher than the companies replaced at 15.6%.

Conventional valuation metrics for the portfolio at year end:

| Holdings | Price to 2013 EPS |

Cash flow Growth |

Return On Assets |

Return On Equity |

|

| Bristol Gate Fund | 22 | 11.3 | 8.8% | 10.2% | 34.5% |

| S&P500 | 500 | 13.3 | 3.7% | 8.4% | 21.6% |

We don’t find exceptional dividend growth in all sectors or industries. Hence our portfolios are typically more focused. Following is Morningstar’s analysis of the sector distribution of the Fund’s portfolio. We have moved from consumer defensive stocks [McDonalds, Family Dollar and Wal-Mart] into consumer cyclicals and media [Ross Stores, Target, CBS and Disney], which we believe reflects the economic recovery now underway in the United States. Our focus on industrial companies has been maintained.

| SECTOR | PortfolioWeight | S&P 500Weight |

| CYCLICAL | 49.14% | 28.14% |

| Materials | 4.62% | 2.91% |

| Consumer cyclical | 35.06% | 9.65% |

| Financial services | 9.47% | 13.44% |

| Real estate | Nil | 2.13% |

| SENSITIVE | 37.33% | 45.21% |

| Communications | Nil | 4.53% |

| Energy | Nil | 11.26% |

| Industrials | 32.84% | 10.84% |

| Technology | 4.49% | 18.57% |

| DEFENSIVE | 13.52% | 26.65% |

| Consumer defensive | 9.02% | 11.41% |

| Healthcare | NIL | 11.81% |

| Utilities | 4.50% | 3.43% |

Source: www.morningstar.com Companies in the index are weighted by market capitalization.

To provide some insight into some of the questions we ask when we evaluate a company, we include a brief analysis of Union Pacific Railroad, a company we have owned since the fund was started.

LOOKING AHEAD

Looking ahead to 2013 we believe markets are focused on two significant concerns. Firstly, in the US the steady rise in consumer confidence as households rebuild their balance sheets will continue with extremely low interest rates and some clarity on the public policy issues in Washington. There are signs of a housing recovery throughout the United States, which we expect will support this optimism.

The following chart illustrates the performance of the residential real estate market in the United States. There is evidence that the market “bottomed out” in 2012 which, when coupled with the improvement of consumers balance sheets [the US Federal Reserve reports that in the 3Q2012 households net worth and personal income climbed to their highest levels since 2007], provides a base for a continuing consumer recovery.

There has been concern about the effects of income taxes on dividend and capital gains in the United States on the investment sector. Although this issue is not fully resolved by Congress, we expect a minimal impact on our portfolio, since our dividend yield is low [slightly less than 2%] and there is evidence that dividend growth in our portfolio companies will continue in 2013 at the 15% standard we have experienced to date. It is the dividend growth that eventually drives stock prices.

ABOUT US

In the past year our research efforts have been directed at two initiatives:

- A Canadian income growth portfolio: this is now in the testing stage as we are confident we have an analytical method to identify Canadian companies with growing dividends

- A portfolio risk analysis system that would allow us to develop sound methods to evaluate client’s portfolios and establish asset mixes that would contribute to reducing risk

We have established an offshore fund registered in the Cayman Islands, with Scotiabank as our custodian and banker, to allow non-Canadian investors to participate with us.

In 2012 Ryan Murphy joined the company from UBS, a large Swiss bank. Ryan also has employment experience with Harris myCFO in Atlanta and BMO Private Client Group in Toronto. Ryan is a CFA charter holder and earned an MBA from Windsor.

This year the “tracking portfolio” is entering its sixth year and, despite being tested by volatile markets in the face of major economic shifts and skeptical investors, we have managed to perform well on the investment stage. Our confidence in our ability to manage downside risk has increased thanks to the excellent efforts of our research staff whose job it is to be ever vigilant in protecting the capital entrusted to us.

Thank you for the opportunity.

We wish you all the best for 2013.

Sincerely,

| Richard Hamm Chief Executive Officer  |

Peter Simmie Chief Investment Officer  |